Moggio wrote:

ONE. MORE. TIME. FOR. THE. WORLD.:

It is NOT possible to print $100 BILLION per month and not technically have hyperinflation.

LMFAO, according to who? Find anyone other than a internet dumb ass on a message board who agrees with that definition of hyperinflation.

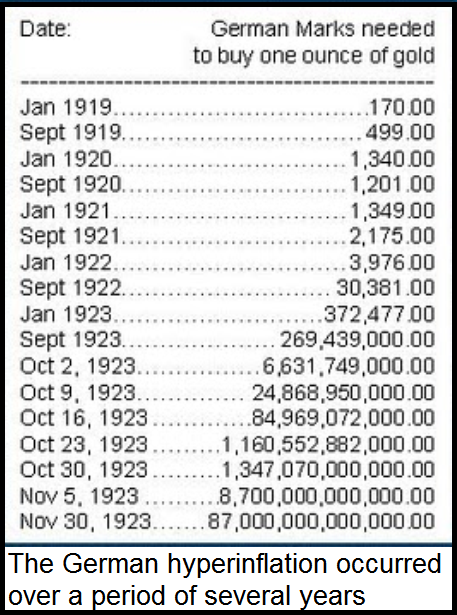

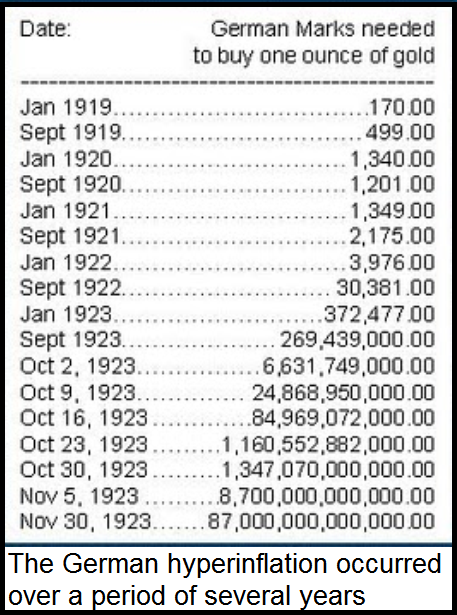

Moggio, it is possible for the Fed to print 100 billion a month and not have hyperinflation. Hyperinflation requires not only money printing but a constraint on production. Capacity utilization is 77% right now. Back in 97 it was 85%. There is no constraint on supply. In Zimbabwe there was a constraint on land. In Germany, they lost their industrial region to France as part of reparations. There is no constraint on supply in the US and no possibility of hyperinflation, or even high inflation.

Also, the Fed is not currently printing 100 billion a month. The precondition for your childish definition is not even met.

Moggio wrote:

The ONLY reason why inflation is barely OFFICIALLY above 1% right now is because the Fed is ARTIFICIALLY manipulating the rate to prevent the Currency/Treasuries Bubble from bursting so we don't go into a Depression (which is a strategy that won't last very long). What part of that do you not understand, dipshits?

Nobody understands that Moggio because it makes no sense. If a treasury bubble collapsed, interest rates would go through the roof. Higher interest rates would restrict credit and the consequence would be disinflation or even deflation. That means a stronger dollar, not a currency collapse. A collapsing treasury bubble would not lead to hyperinflation or coincide with a currency collapse. Your storyline makes no economic sense. It's merely a list of a few bad economic events mashed together.

You're claiming the Fed is engaging in quantitative easing to contain hyperinflation and that once they stop buying bonds, the bond bubble will burst? The Fed is buying bonds to generate inflation, create demand in the economy, increase capacity utilization and reduced unemployment. They are not buying bonds to prevent a dollar collapse as you claim. In your backwards world, the Fed generates inflation by restricting credit.

In what sense is there a currency bubble? A bubble relative to what? Other currencies? The dollar is basically where it was in April 2007 when the Fed Funds rate was 5.25%.

Price-adjusted Major Currencies Dollar Index -- Monthly Index

http://www.federalreserve.gov/releases/ ... exnc_m.htm

APR 2007 87.9694

APR 2013 86.3115

You claim once the Fed stops buying treasuries the treasury bubble will pop? The Fed only bought 2.7 billion in treasuries in 2012. Interest rates on the 10 year fell from 2.04% to 1.95%. The Fed is not propping up a treasury bubble. People are buying treasuries because treasuries are a safe investment and they are risk averse. As investors become less risk averse, treasury yields will rise (prices will fall) but a bubble will not burst. There is not a speculative treasury bubble where investors are borrowing and buying/selling bonds to chase a quick profit.

U.S. Treasury securities held by the Federal Reserve: All Maturities

http://research.stlouisfed.org/fred2/graph/?g=j5M

2012-01-04 1663438

2013-01-02 1666118

10 year treasury

2012-01-01 2.04%

2013-01-01 1.95%

There is no currency bubble. There is no treasury bubble.